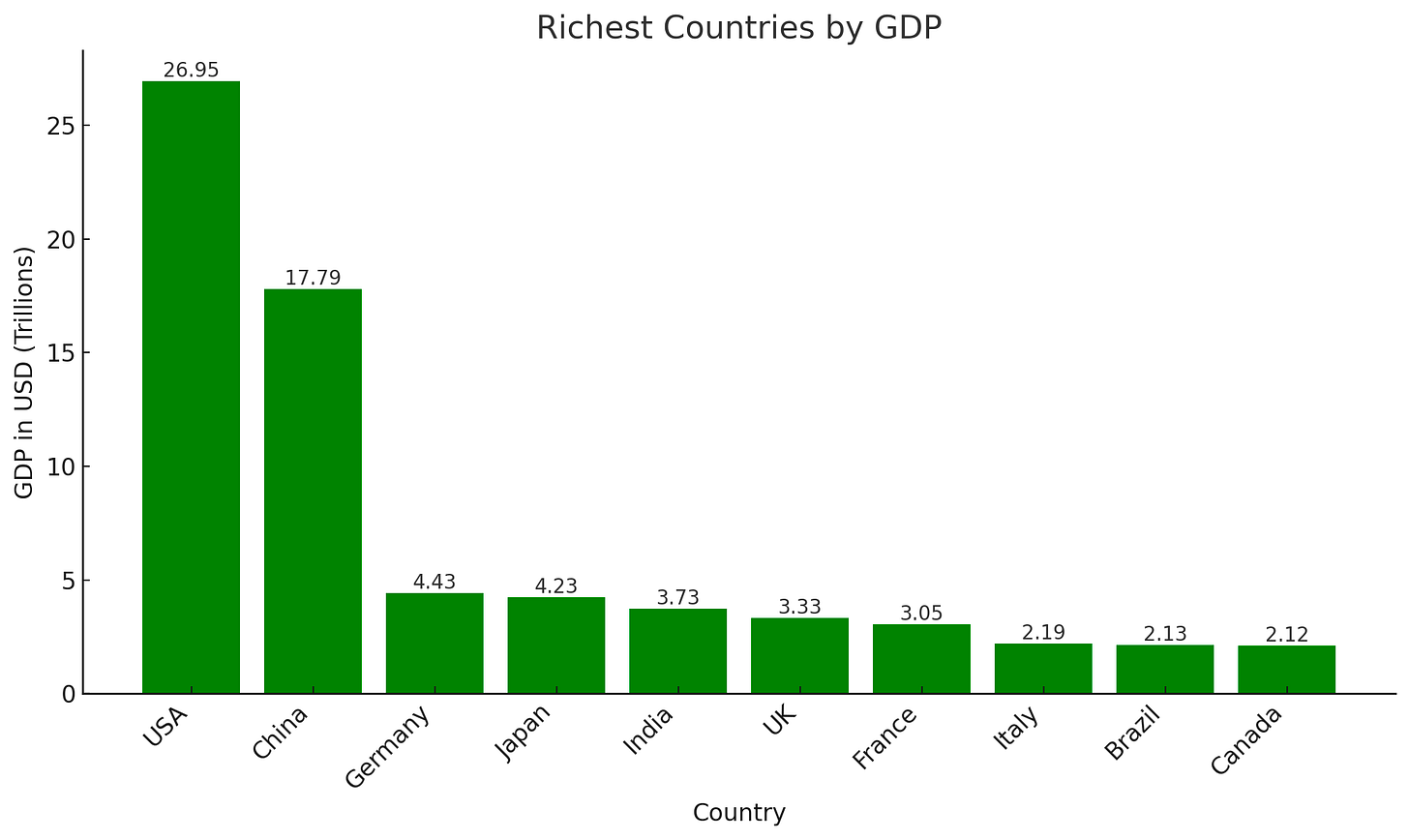

In the intricate dance of economic indicators, GDP often takes center stage.

The US economic machine is a noticeably absurd. GDP effectively shows the size and health of a nation's economy within its borders. It provides a snapshot of national economic activity and growth but it doesn’t tell a deep story.

Yet, in the backdrop of GDP is its less discussed counterpart: Gross National Product (GNP). Unlike GDP, which measures output within border lines, GNP shifts the focus to nationality. Accounting for the total income generated by the residents of a country, regardless of where the economic activity happened. This subtle difference between GDP and GNP can unveil deep insights about a countries economic story. In the difference between these two metrics we can uncover compelling stories of global interdependence, foreign investment impact, and a deeper understanding of economic growth and stability.

Tales of Divergent Metrics

Luxembourg: Crossroads of Commerce

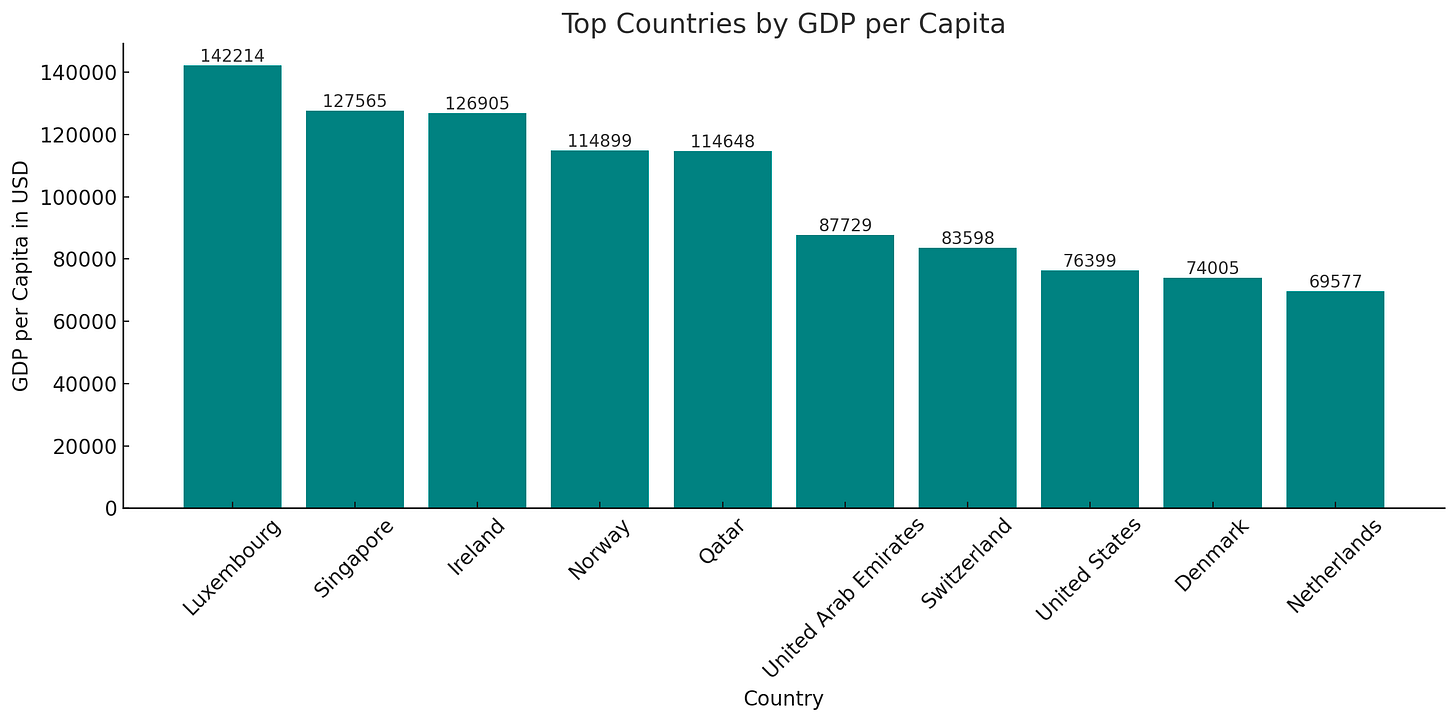

Across the landscape of global economies, Luxembourg constantly stands out for its economic affluence. When looking at GDP per capita, it consistently tops the list of world economies.

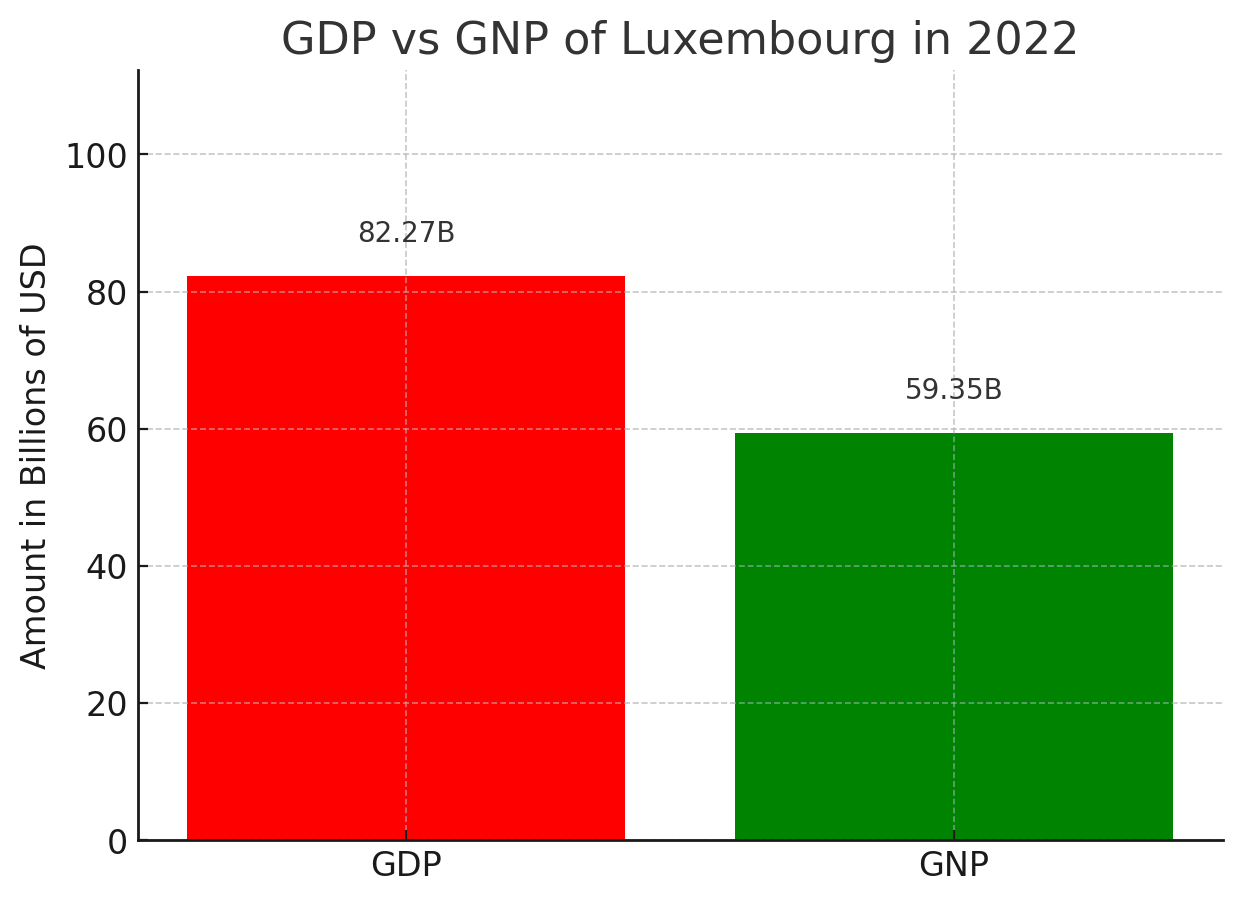

Luxembourg's GDP reflects its status as a global financial hub and a host for multinational corporations. However, when we shift focus to its GNP, which measures the total income of its nationals it tells a different story.

The GNP is notably lower than the GDP, a discrepancy that reveals the extent of foreign involvement in Luxembourg's economy. The key to understanding this gap lies in Luxembourg's demographic and economic structure. Luxembourg has a small population of ~660K people and within that population only half are Luxembourg nationals. This influx of foreign labor and expertise inflates the GDP, making it a less accurate reflection of the wealth accruing to Luxembourg's citizens.

For its size, Luxembourg has massive international leverage. The difference between Luxembourg's GDP and GNP is more than just a statistical curiosity, it presents a unique narrative in global economics and the nature of its prosperity. It tells a story of an economy deeply integrated into the global financial system, reliant on foreign labor and capital.

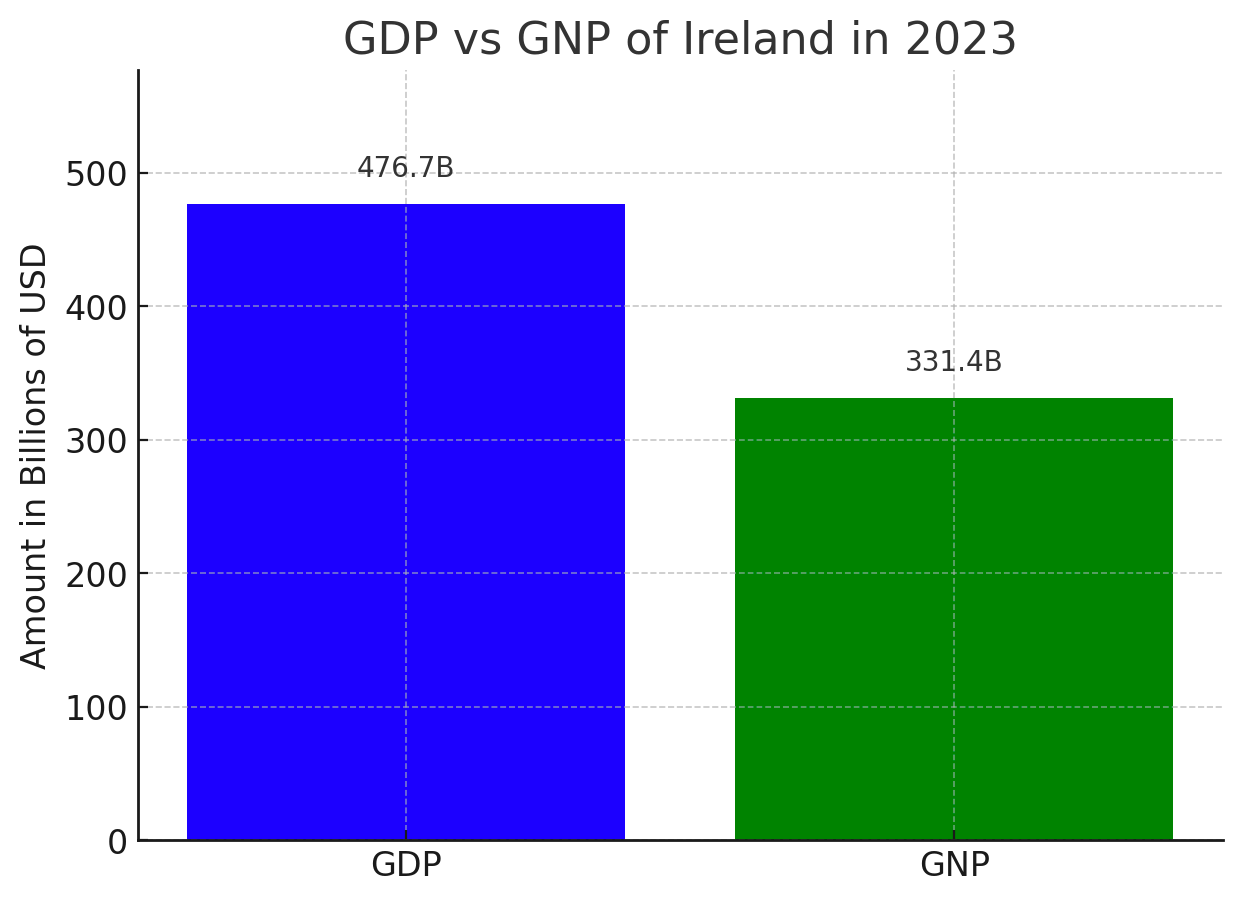

Ireland: A Foreign Investment Haven

Another nation with a large gulf between their GDP and GNP is the land of a thousand welcomes.

The heart of this disparity tells a similar but different story to Luxembourg. Ireland is incredibly successful at attracting direct foreign investments (FDI). Ireland has been a preferred European base for numerous multinational corporations due to its favorable corporate tax regime, skilled workforce, and membership in the European Union. While these companies contribute massively to Ireland's GDP, much of their profits are repatriated to foreign owners. An aspect of this phenomenon is the concept of "profit shifting." Many multinationals, particularly in the tech and pharmaceutical industries, report large portions of their profits in Ireland to benefit from the lower tax rates. This accounting practice inflates Ireland's GDP but does not proportionately increase the wealth of Irish nationals, hence the significant GDP-GNP gap.

While this model has driven economic growth and employment, it can also be a weakness. Dependency on multi-national corporations is a potential vulnerability that could result in large economic swings when global interruptions occur.

Tales of Remittances

Flipping the script, we can find unique economic stories when GNP is much higher than GDP. This flip is typically representative of countries with large remittances.

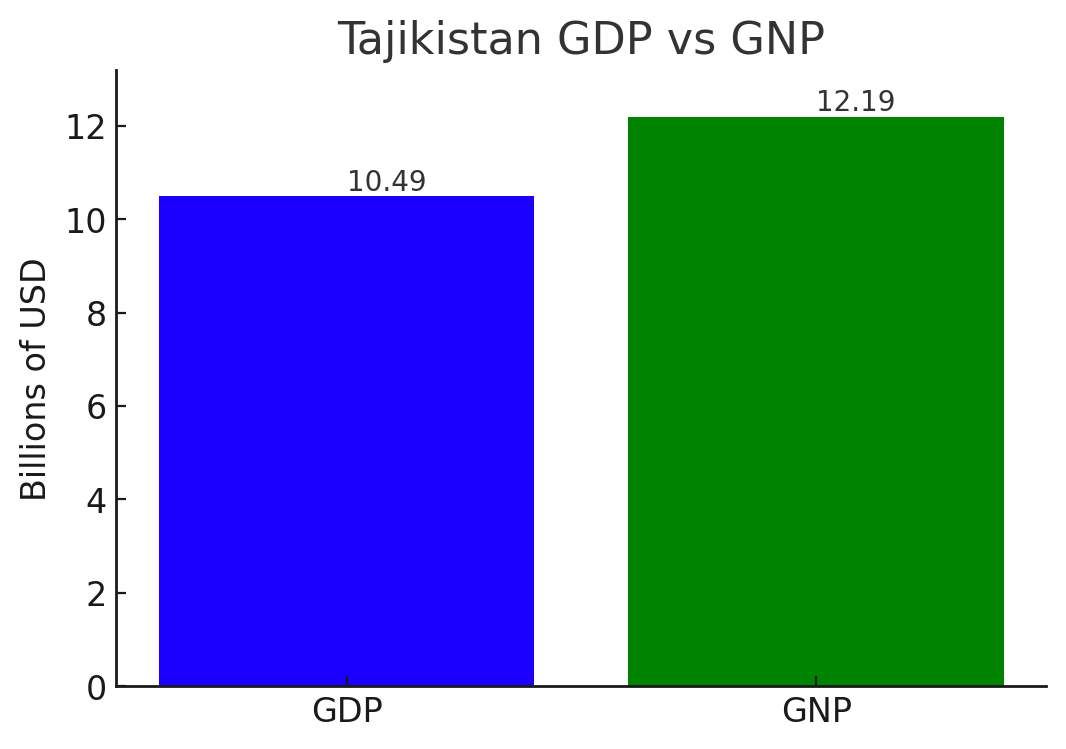

Tajikistan's Remittance Saga

Tajikistan tells a tale of remittances.

With a GNP bloated by funds flowing from abroad, Tajikistan’s story is one of economic reliance on its diaspora, a stark contrast to its modest GDP. Remittances by Tajik citizens serve as a lifeline for many households, bolstering domestic consumption and aiding in alleviating poverty. The funds received from abroad are often utilized for basic needs, education, and healthcare.

Almost half of the Tajikistan GDP comes from these remittences. There are limited job opportunities and economic uncertainty in Tajikistan. Remittances play a stabilizing role in an unstable environment.

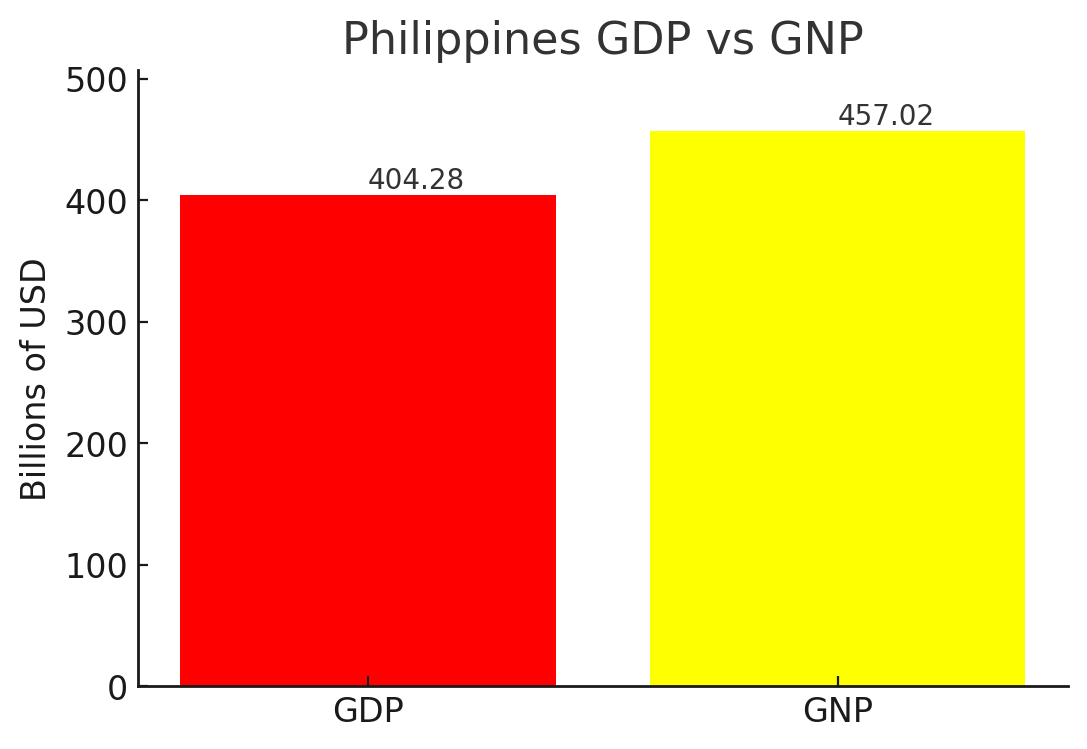

Philippine’s Story of Overseas Connection

Overseas Filipino Workers (OFWs) also tell stories of remittences. The Philippines is one of the world's largest recipients of remittances, making this financial inflow a pivotal component of its economy.

In the Philippines, working abroad and sending money home has become a cultural norm, driven by both economic necessity and a deep-rooted sense of familial responsibility. The decision to become an OFW is often seen as a sacrifice made for the betterment of one's family, and the act of sending remittances is viewed as an extension of the Filipino values of generosity and familial care.

Remittences serve as an economic lifeline for many families, help stabilize their economy, and play a critical role in reducing poverty and improving living standards. Despite their benefits remittences are also an economic dependency. This can be a vulnerability if global conditions deteriorate and affect an OFW’s ability to send funds back home. The absence of family members working abroad can also have social and psychological impacts, particularly on children left behind.

Global Stories of Interconnectedness

India's Remittance Storyline: India’s GNP is heavily embroidered with the thread of remittances, overshadowing a GDP that struggles to keep pace. This contrast tells a story of an economy with a heartbeat resonating across oceans.

Switzerland's Banking Plotline: Switzerland’s tale is penned with the ink of global finance. Its GDP, bolstered by a legendary banking sector, often overshadows the domestic economic narrative captured by its GNP.

Mexico's Remittance Narrative: Much like the Philippines, Tajikistan, and India, Mexico’s GNP is buoyed by remittances. This influx of funds from abroad writes a story of a nation economically intertwined with its citizens beyond its borders.

Singapore's Global Business Epic: Singapore, a protagonist in global business, has a GDP narrative dominated by international trade and investment. This city-state’s economic plot twists and turns with the flows of global capital.

In the theatre of global economics, the delta between GDP and GNP is a window into the soul of a nation's economy, revealing tales of dependence, independence, and interconnection. This exploration enlightens us about the diverse economic landscapes and underscores the intricate tapestry of global economic relations.